Category: Technology

-

Kuwait’s Green Future – Sunshine and Sunflowers – Article for Al Jarida 23 December 2016

Author Jeremiah Josey This article was written for the Al Jarida newspaper and published on Saturday 23 December 2016. This article took a full page to discuss the economics of solar energy in Kuwait. It is published here on page 10: Al Jarida Article 23 Dec 2016 Kuwait’s Green Future – Sunshine and Sunflowers I saw…

Written by

-

The End of Oil? Oil Pricing for 2015 and the Rise of Solar Energy

Best Business Practices, Energy, Global Issues Affecting all of Us, Money, Solar Power, Technology, The Middle EastAuthor Jeremiah Josey I wrote this article for the Al Jarida newspaper and it was published on Saturday 24 January 2015. It’s a further development of my previous blog on how technology is changing the way the energy market operates and how the oil price may never rise again. It is published here: Al Jarida…

Written by

-

Brilliant, and Ancient Technology

Author Jeremiah Josey, 13 January 2013 This is the famous 12 sided stone in Hatum Rumiyoc Street, Cusco, Peru. It is 1,000’s of years old, carved with a technology long forgotten by man, and is in fact lost to modern science. We do not know how it was done, and we do not know who did…

Written by

-

The End of Humanity? It’s All in the Numbers

Author Jeremiah Josey, MECi Group For the human population to remain steady, each woman needs to have at least two children – one to replace herself and one to replace her mate. The actual number works out to be about 2.1 – to allow for accidents and the like. In this very good presentation by Hans Rosling,…

Written by

-

Read The Manual

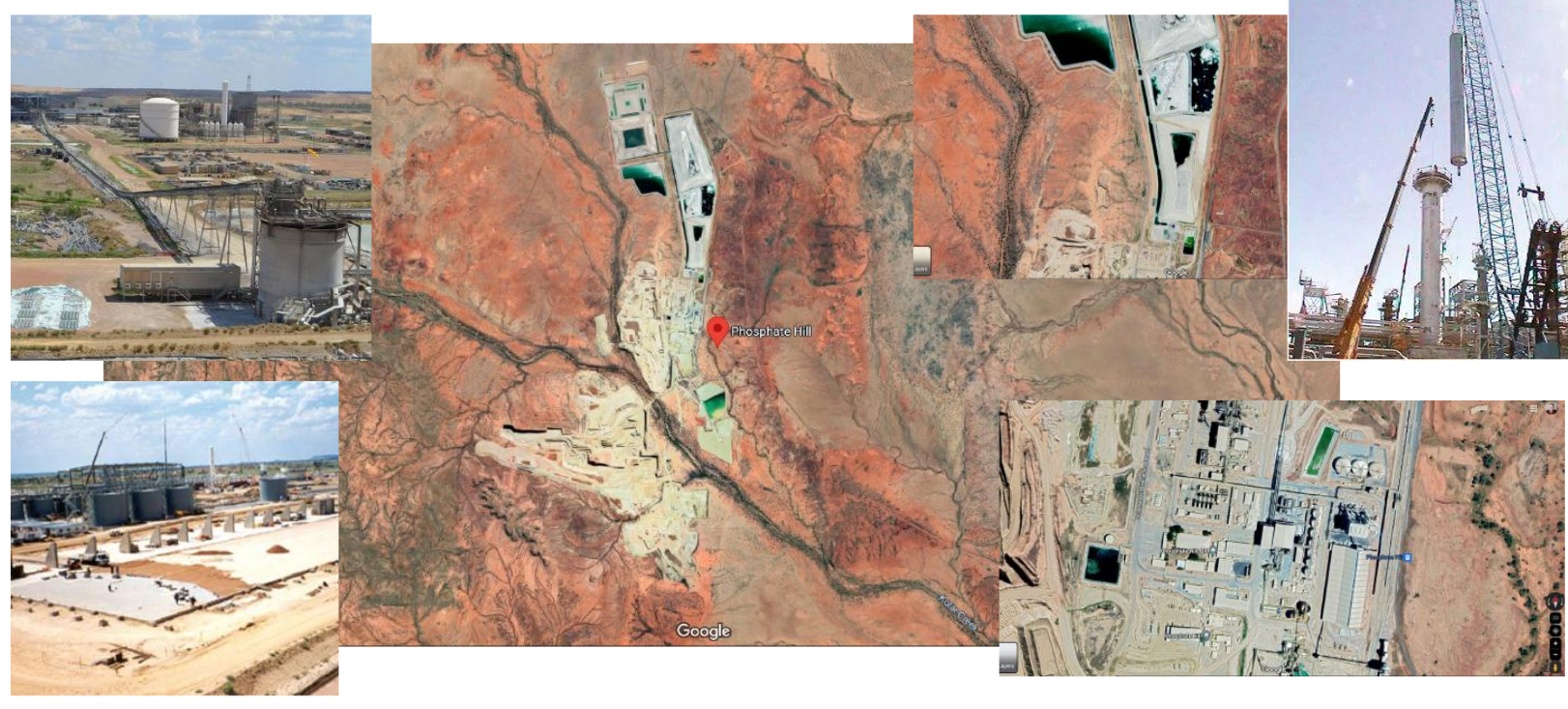

Author Jeremiah Josey, MECi Group A handful of years ago I was asked to join Western Mining and build a major part of their new AUD 1 billion fertiliser facility in far north western Queensland. Western Mining was then led by two icons of the Australian mining industry, Hugh Morgan and Andrew Michelmore. The facility…

Written by

-

How to get a 1 hour suntan in 5 minutes

Author Jeremiah Josey, MECi Group I was sitting by the pool today (as I often do), thinking about stuff (as I often do)… I was thinking about a movie called Sunshine released in 2007. An excellent Si-Fi movie set 50 years into the future when the sun is dying. (Worth a watch by the way.…

Written by

-

The Mediocrity of Australian Politics

Author Jeremiah Josey, MECi Group Recent public movements in Australian politics reveal the truth behind the talking: National interest, getting things done, change for the good of everyone? These are not on the agenda. Personal interest, personal gain and tepid caution: these are what drives the upcoming Australian election. As pointed out by Leigh Ewbank in…

Written by

-

Food, Inc. A review of the documentary – recommended

Author Jeremiah Josey, MECi Group What a great documentary. Not just because of the story (eat food in the USA? Yuck), but also because of the great positive, do something message at the end. Let’s start with that message: “You can vote to change the system… three times a day Buy from companies that treat……

Written by

-

Great People – Dean Karmen

Author Jeremiah Josey, MECi Group You can learn about a guy called Dean Karmen from a book called Project Ginger: about how Dean made the segway (and other neat inventions) It’s thanks to people like Dean Karmen that we get to experience marvellous “miracle” technology as “common place” after millions of dollars and millions of human…

Written by

-

Antibiotics – Short Term Thinking Kills A Long Term Future

Author Jeremiah Josey, MECi Group Medical topics are not something I usually blog about, but I liked this one because what has happened here is exactly what has happened in so much of our – human – endeavors, and it stems from short term thinking. In this case, short term thinking gave a solution that…

Written by

-

Shift Happens

[youtube=http://www.youtube.com/watch?v=cL9Wu2kWwSY] Created by Karl Fisch in 2006 Jeremiah Josey

Written by