I wrote this article for the Al Jarida newspaper and it was published on Saturday 7 February 2015.

This article took a full page as I was developing an argument for Kuwait and other oil rich countries after demand for crude oil declines. It is published here: Al Jarida Article 7 Feb 2015 (Go to page 12)

After Oil: Money, Food and Polymers – New Business Activities for the Middle East

Fourteen years ago the former Minister of Oil for Saudi Arabia, Sheikh Ahmed Zaki Yamani said that by 2030 oil would remain in the ground because people would not want it. One oil rich country, Iran, is discussing their future budgets without oil. I have written previously about how dramatic falls in energy creation from solar radiation is now a direct competitor to burning fossil fuel. So what can economies that are heavily reliant on oil revenues such as Kuwait do in a post oil world? This is what I will discuss in today’s article.

Based on experience, for a change to take place in any market there must be three major forces that come together at the same time. These three forces are: Economic, Social and Technical. If a market or industry sector has these forces in play, then it will change. Let us look at the oil market and see if these forces are present.

Economically? Yes. Falling prices have made many oil reserves uneconomic. Falling prices of other energy sources drives consumers towards them.

Socially? Yes. Climate change issues are affecting the entire world and reducing carbon dioxide production is now a topic of common discussion. The United Nations Framework Convention on Climate Change (UNFCCC) and the Intergovernmental Panel on Climate Change (IPCC) are both very vocal in the need to curb carbon dioxide emissions immediately. Not next year, but now. Today. Yesterday if they could do it.

Technically? Also yes. Energy can be produced as efficiently from the sun and the wind as it can from fossil fuels (coal, oil and gas).

So it seems the forces are aligned. Hence the market will move. Then the question remains, what does this mean for countries that are heavily reliant upon fossil fuels, especially crude oil, for their state revenues? Something needs to change. Business will have to divest and reinvest in order to create new revenue streams.

There is a catch however, a complex economic catch. In countries where oil revenues provide a lot of state revenues, oil production is also very cheap. For example in Russia, oil production cost is around $15 per barrel. It’s about $10 per barrel in Iran and less than $5 per barrel in Saudi Arabia, Iraq and Kuwait. New revenue streams however will come with higher operating costs, high retooling costs (more capital investment) and high human capital retraining costs. Margins will be less. Hence there must be significant increases in revenue by these lower margin activities to cover the revenues lost by a fall in oil demand. It will be difficult.

So with that groundwork laid, I boldly predict that for oil rich states such as Kuwait that once oil demand declines there are three areas that can replace oil revenues. These are:

1. Finance, equity and debt investments, investment yields 2. High value polymer production, taking it beyond low value petrochemicals 3. Aquaculture for high efficiency protein production

These income streams can either occur through private ownership, in which case taxation regimes would be required to provide state revenues. Or the ventures would be state owned and continue to operate much like the oil and gas sector operates now. The later would be a tall order. The economic efficiencies necessary in these new industries will not allow traditional work ethics common with the high margin, easy to produce revenues from crude oil. Therefore state governments will get smaller. The private sector will grow, if it can. Private sector needs three factors in it’s favour to thrive: 1) great infrastructure – transport, communications, access to liquidity; 2) excellent legal systems; 3) low taxes. This is something Dubai has been developing and they appear to be doing well.

Let’s go through each one of these three new revenue options in turn, using Kuwait as an example and the benchmark of $50b – Kuwait’s gross income with crude oil price at $45 per barrel.

1) Finance, Equity and Debt Investments, Investment Yields

Sovereign wealth funds of the Middle East are in an ideal position to expand their operations to replace falling oil revenues. Since 1953, the Kuwait sovereign investment fund has accumulated an estimated $550b in assets. Therefore, quite simply, a 10% yield on investment would replace all present revenues from crude oil.

But can you get such a high yield on so much capital? You can. You can even get more.

Berkshire Hathaway, the very well known investment group established by Warren Buffet in the 1960’s, holds net assets of $484b. Their net revenues have averaged 20% per year for the past 50 years.

This demonstrates that high yields are achievable.

Employing 330,000 people, Berkshire Hathaway presents a viable model for Kuwait moving forward after oil. Raising the level of investment knowledge therefore is an important skill to develop amongst Kuwaitis. The management of such investment could be achieved by creating 100 investment groups each allocated $5b. Each group would be set the target to achieve 20% or more net annual revenues. It would be survival of the fittest. Consolidation, knowledge transfer and then further expansion would increase the performance of the funds and the skills of the investment management teams.

From first hand experience, investment yields greater than 50% are possible when carefully selected and expertly executed.

So the management of money is a viable solution to entirely replace revenues from falling oil demand.

2) High Value Polymer Production, Taking It Beyond Low Value Petrochemicals

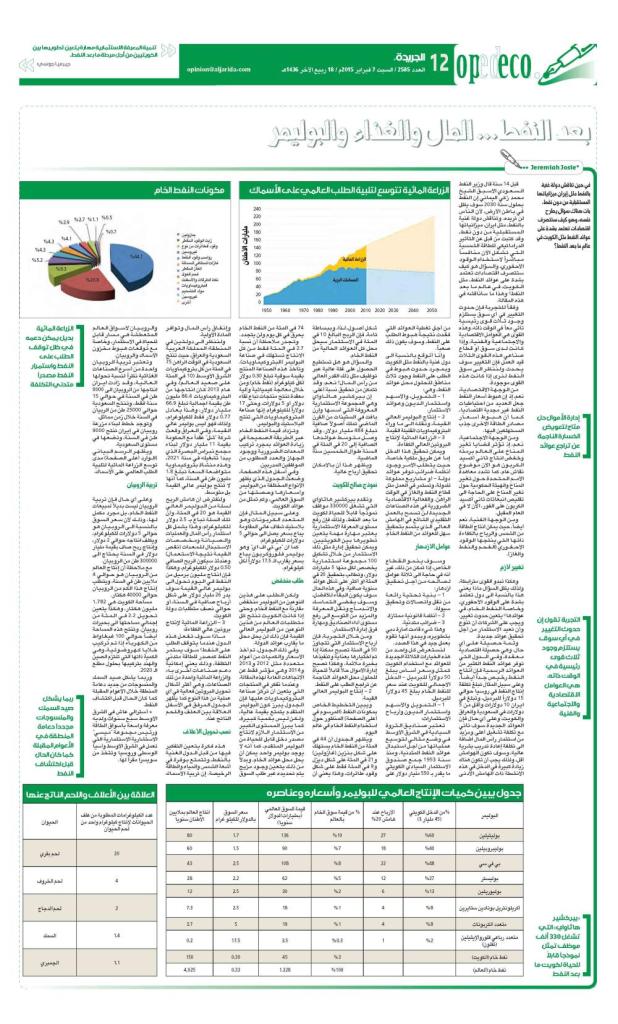

Here is a perspective of the use of crude oil in today’s world:

From Renewable Energy World

The chart shows that 44% of crude oil is consumed as gasoline, 21% as diesel, and 9% as jet fuel. That means that 74% of crude oil is burnt every day, never to return, non-renewable.

Notice that only 2.7% of all production is consumed in the polymer industry – petrochemicals. This is an industry that takes a product with a market value of $0.30 per kg (crude oil), and then, with complex chemical and mechanical processes, produces products that sell for $1, 5, even $17 per kg. This industry is is the petrochemical industry, producing plastics and polymers.

Value adding to crude oil is a straightforward way to increase revenues once you have installed the necessary equipment and have the required numbers of trained personnel.

I have put together the table below to show different polymers with their prices, their world market share and how much of Kuwait’s revenue this would represent.

For example polycarbonate, a transparent, highly impact resistance plastic common in the automotive industry, sells for about $5 per kg.

PTFE, a high tech fluorocarbon polymer sells for about $17.5 per kg.

But the demand for both of these polymers is low compared to crude oil volumes. Even if Kuwait was producing all of the worlds requirements for these two high value polymers, it would not provide any where near the replacement revenue for the State.

|

Polymer |

World Production (million tonnes per year) |

Bulk Market Price ($ per kg) |

World Market Value ($ billion per year) |

% of World Crude Market Value |

Profit at 20% Margin |

% of Kuwait Income ($45b) |

|

Polyethylene |

80 |

1.7 |

136 |

10% |

27 |

60% |

|

Polypropylene |

60 |

1.5 |

90 |

7% |

18 |

40% |

|

PVC |

43 |

2.5 |

108 |

8% |

22 |

48% |

|

Polyester (PET) |

28 |

2.2 |

62 |

5% |

12 |

27% |

|

Polyurethanes |

12 |

2.5 |

30 |

2% |

6 |

13% |

|

Acrylonitrile-Butadiene-Styrene (ABS) |

7.3 |

2.5 |

18 |

1% |

4 |

8% |

|

Polycarbonate |

3.7 |

5 |

19 |

1% |

4 |

8% |

|

PTFE (Teflon) |

0.2 |

17.5 |

3.5 |

0.3% |

1 |

2% |

|

Crude Oil (Kuwait) |

150 |

0.30 |

45 |

3% |

||

|

Crude Oil (World) |

4,025 |

0.33 |

1,328 |

100% |

Prices and quantities are from various years eg 2012, 2013, and 2014 and are indicative only for the purposes of general trends and forecasting for this article. Further details analysis would be necessary to undertake investment level decisions.

When considering what products the petrochemical industry should focus on, the table highlights that advanced polymers are high value but are not high volume. It also highlights the large scale of investment needed to produce a viable revenue source from advanced polymers. Also there is no one single polymer that would replace crude revenues. Instead a mix would be required, determined by market demand, capital expenditure, and feedstock availability.

Let’s consider two countries in the region, Saudi Arabia and Iraq. Saudi Arabia presently produces 75% of all Petrochemicals in the Middle East (and 10% worldwide). In 2013 Saudi petrochemical production was 86.4 million tonnes and the total value was $66.9b. Note that this equates to only $0.77 per kg, so it’s not in high value polymers, but in mid value intermediate polymer feedstock. In Iraq, Shell has just signed a $11b deal with the Iraqi government to build the Basra Nibras complex (operating by 2021). This is a petrochemical facility with a modest 1.8 million tonne per year capacity. Also, it is not making high value polymers, only intermediary polymer feedstock. Further capital investment is required to do higher value adding.

For an exercise, let’s assumed that the profit margin for a basket of high value polymers is 20% and that that basket sells for $2.5 per kg. This includes all capital investment, operations, maintenance and replacement allowance for the equipment (depreciation). Therefore the net profit will be $0.50 per kg. Thus, with 1,000,000 barrels per day of oil (123 million tonnes per year) converted into a high value polymer would yield $26b in net profits per year, or about half of Kuwait state requirements.

So this is possible, though with considerable capital investment and the time to establish it.

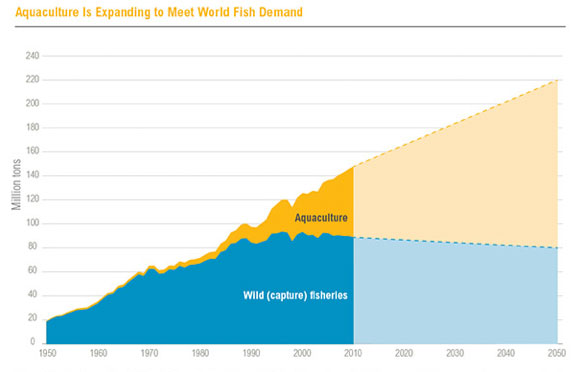

3) Aquaculture for High Efficiency Protein Production

What else can these countries do when oil is no longer wanted for burning? Well, it will still remain a low cost source of energy, and that means that other industries can be supported with it. One such industry is aquaculture, the most efficient form of protein conversion of any animal husbandry practice, as the table below highlights:

Feed Conversion Ratios

|

Animal |

Kilograms of Animal Feed to Produce 1 Kg of Animal Meat |

|

Beef |

20 |

|

Sheep |

4 |

|

Chicken |

2 |

|

Fish |

1.4 |

|

Shrimp |

1.1 |

This is food for thought for oil rich nations with abundance of sunshine, water, and hence cheap energy. Growing fish and shrimp for hungry expanding world markets is a possible viable investment path, especially as the forecasts of collapsing wild fish and shrimp stocks come more frequently into the news.

One of the fastest growing food industries due to it’s high feed conversion ratio is shrimp farming. Iran has increased shrimp production to 8,000 tonnes per year in only about 15 years, and Saudi Arabia is producing about 25,000 tonnes of shrimp per year over a similar time frame.

There are plans for a 9,000 tonne per annum shrimp farm in Iran which will double production from that country and put it on level with Saudi Arabia.

However, growing shrimp is not a replacement for crude oil sales. It’s a supplement.

Here’s why.

The market price for shrimp is around $5 per kg and they cost about $2 per kg to produce. Hence the net margin is $3 per kg.

To produce $1b net profit per year requires 300,000 tonnes of shrimp.

Note that world shrimp production is about 4 million tonnes per year.

About 40,000 Ha is required to produce this much shrimp (if growing white tail vannamei).

The Kuwait land area is 1.782m Ha, so 2.2% of Kuwait’s total area would have to be converted to shrimp ponds.

Incidentally this much land would also produce about 100 GW of electricity if photovoltaic cells where installed. This is the same amount that both China and India are committing to install by the early 2020’s.

So the volume of resources required is large whilst the net return is comparatively low, despite the fact that it is healthy and expanding.

So, there you have it. A stool with three legs provides the greatest stability:

1. Finance 2. Polymers 3. Food

Perhaps fishing and textiles will again be the mainstay for the region in years to come as it was before oil.

Author Deck Mr. Jeremiah Josey is an Australian who has been living in the Middle East for 7 years. Knowledgeable in the energy markets, he is the Chairman and Director of Oil & Gas of Swiss based Meci Group, a business and investment consultancy operating across the Middle East, Central Asia and Russia.

People have for long been saying that the end of oil will come and it never seems to happen. Although I do feel as if renewable energies are the future, I do believe that oil will not go away during our life time. So much is invested in oil and we use it for so many things…it’s hard to believe that it will be so irrelevant within just 15 years.

Yes true. Watch and see