Category: Investment

-

Hot or Not? Why Investing into Nuclear is the best for the 21st century

Written by Jeremiah Josey, 4 May 2024 China’s nuclear transformation is one of the most important, yet misunderstood, energy stories of the 21st century—and it was at the heart of a presentation I delivered to around one thousand Chinese investors in Hong Kong in September 2023. Speaking not as an armchair commentator but as a…

Written by

-

Demographics and market predictions – where Austrian reality trumps Keynesian mythology

Author Jeremiah Josey, 31 March 2020 Here is Robert Kiyosaki interviewing the great Harry S. Dent Jr. in a timely reminder of the importance of demographics. This is relevant in our covid-19 panic stricken world amid collapsing interest rates and voluminous fiat stimulus. The irony of our times: Keynesian based economics, or fluid fiscal spending.…

Written by

-

Generational Wealth Comes from… Generations

Tracing the Josey linage back several hundred years into wealth measured in billions today.

Written by

-

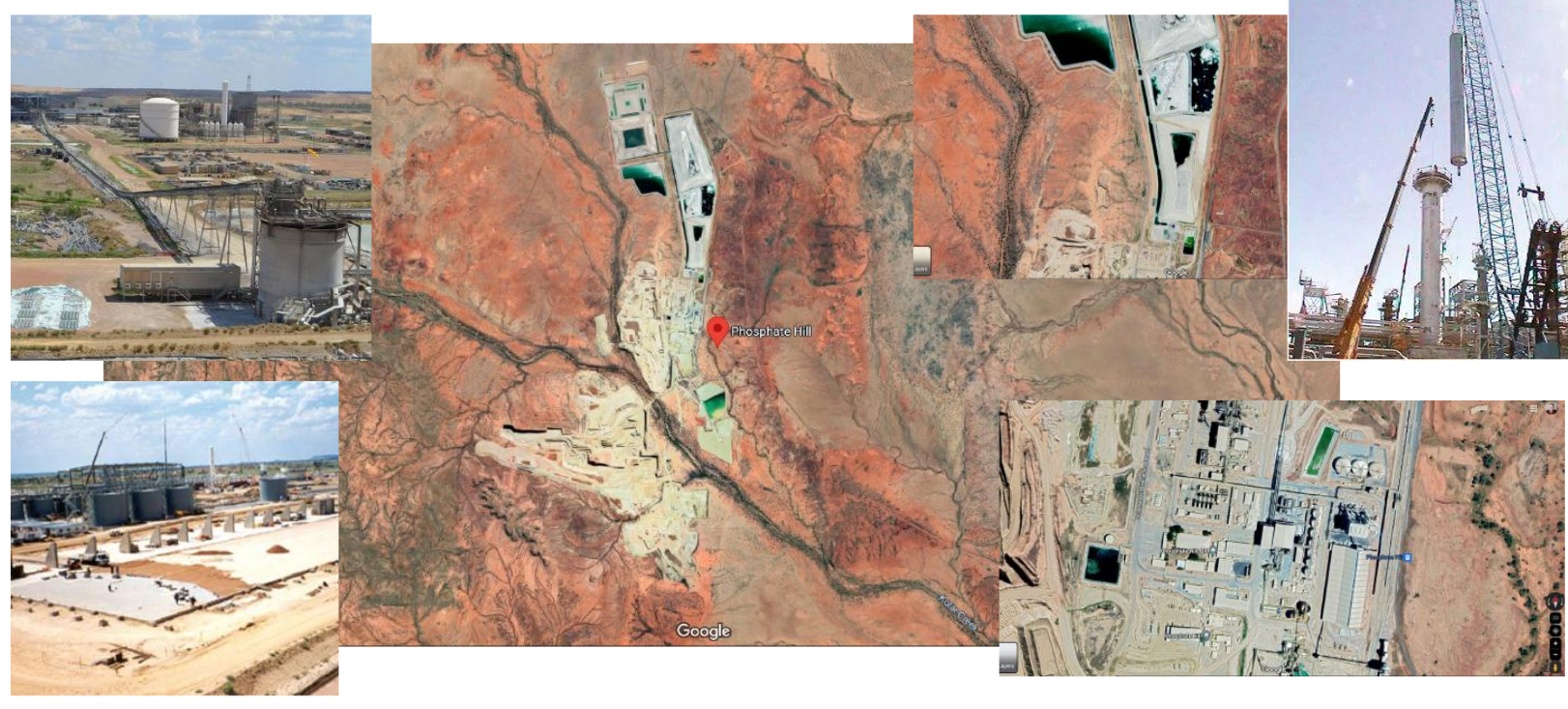

Read The Manual

Author Jeremiah Josey, MECi Group A handful of years ago I was asked to join Western Mining and build a major part of their new AUD 1 billion fertiliser facility in far north western Queensland. Western Mining was then led by two icons of the Australian mining industry, Hugh Morgan and Andrew Michelmore. The facility…

Written by

-

How to Become Insanely Rich

Authored by Jeremiah Josey, 18 June 2009 It has been more than 12 years since I built one of my first major capital projects. I was 24 at the time. I hunkered down to do everything that needed to be done to build a major piece of critical infrastructure in a multi-billion dollar refining operation.…

Written by