Category: Energy

-

Hot or Not? Why Investing into Nuclear is the best for the 21st century

Written by Jeremiah Josey, 4 May 2024 China’s nuclear transformation is one of the most important, yet misunderstood, energy stories of the 21st century—and it was at the heart of a presentation I delivered to around one thousand Chinese investors in Hong Kong in September 2023. Speaking not as an armchair commentator but as a…

Written by

-

The End of Oil? Oil Pricing for 2015 and the Rise of Solar Energy

Best Business Practices, Energy, Global Issues Affecting all of Us, Money, Solar Power, Technology, The Middle EastAuthor Jeremiah Josey I wrote this article for the Al Jarida newspaper and it was published on Saturday 24 January 2015. It’s a further development of my previous blog on how technology is changing the way the energy market operates and how the oil price may never rise again. It is published here: Al Jarida…

Written by

-

2015: The Year For the Downside of Solar Energy and the Upside of Banking

Author Jeremiah Josey, MECi Group Photographer: Chris Sattlberger/Getty Images Downside of Solar? Yes, downside. The side where you slide down and things get easier and more efficient, and lower priced, and better, and people want more of it. That’s what is happening with solar power. Look at this slope for US energy pricing: Source: EIA,…

Written by

-

Is the US Oil Sector in Denial?

Author Jeremiah Josey, MECi Group I came across an interesting article in my email the other morning about how higher energy taxes threaten US shale boom, and I was intrigued not really by the message, but by how the message was being delivered. Being close to the oil sector myself I know that it’s a high-profile…

Written by

-

Wireless Power

Author Jeremiah Josey, MECi Group Recent studies into the prehistoric structures in Egypt and Central and Southern Americas reveal vast spread of knowledge far beyond our own: ancient power stations and wireless power. Tesla in the 1890’s may have rediscovered what was known – and in common use – more than 12,000 years ago. Watch…

Written by

-

No need to be afraid of a tax on carbon

Author Jeremiah Josey, MECi Group http://www.smh.com.au/opinion/politics/no-need-to-be-afraid-of-a-tax-on-carbon-20100903-14tqh.html Love it! Before the Australian election climate change was relegated to a distant nowhere in the election work up of each major party. Now it’s topic to swing a government of some 20 odd million people. Here’s a speech by someone who has a very REAL concern for climate…

Written by

-

How to get a 1 hour suntan in 5 minutes

Author Jeremiah Josey, MECi Group I was sitting by the pool today (as I often do), thinking about stuff (as I often do)… I was thinking about a movie called Sunshine released in 2007. An excellent Si-Fi movie set 50 years into the future when the sun is dying. (Worth a watch by the way.…

Written by

-

The Dark Side of Green

Author Jeremiah Josey, MECi Group I posted a comment here about the real costs of burning hydrocarbons. It was in response to discussion on subsidies on green energy technologies, global warming and everything in between. http://www.linkedin.com/groupItem?view=&gid=62696&type=member&item=25411493&commentID=20660457&goback=.nmp_*1_*1_*1&report.success=8ULbKyXO6NDvmoK7o030UNOYGZKrvdhBhypZ_w8EpQrrQI-BBjkmxwkEOwBjLE28YyDIxcyEO7_TA_giuRN#commentID_20660457 @Brian and @Brennan love the way you think. Clear, clean, concise. Brennan you’d never hit below the belt in…

Written by

-

The Mediocrity of Australian Politics

Author Jeremiah Josey, MECi Group Recent public movements in Australian politics reveal the truth behind the talking: National interest, getting things done, change for the good of everyone? These are not on the agenda. Personal interest, personal gain and tepid caution: these are what drives the upcoming Australian election. As pointed out by Leigh Ewbank in…

Written by

-

An Inconvenient Truth – 3 and a bit Years On

Article by Jeremiah Josey, 14 August 2009 I was recently watching “An Inconvenient Truth” by Al Gore again. Again I was reminded of a large amount of doubt and misinformation wandering about the world on the topic of global warming. Like a frightened rabbit, the lights of the oncoming truck have frozen the collective we…

Written by

-

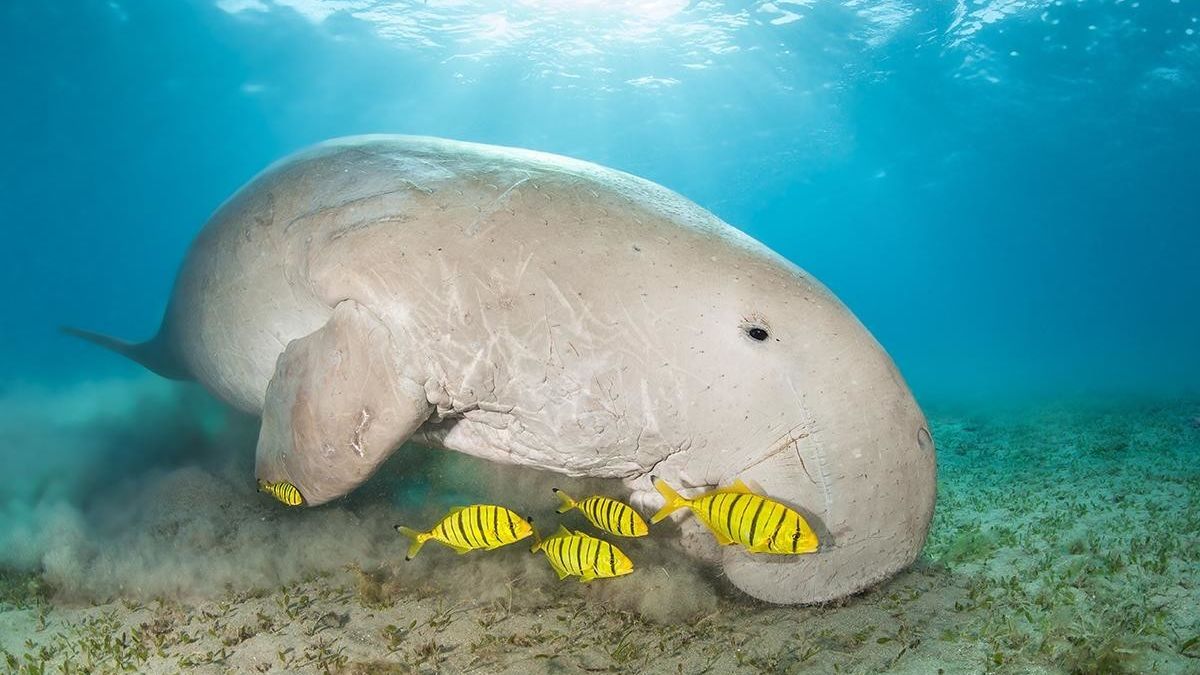

Leveraging Resources – Saving the Whales, and Dugongs

At the same time as I building my butane sphere I was also “Saving the Whales” or rather the dugongs. You see, the BP refinery was sitting at the mouth of the Brisbane River on a small peninsular of reclaimed land from the 1960’s. Every 6 to 36 hours a huge crude oil ship would…

Written by

-

New Oil and Old Hopes – The Bakken Formation

I didn’t know about this one: The Bakken Formation in central USA. A recent U.S. Geological Survey (USGS) report from April 10, 2008 documents the oil reserve in these rocks. Somewhere around 200 billion barrels that lie conveniently in the middle of the USA. The USGS announced that there is about 25 times more oil to…

Written by

-

How to Become Insanely Rich

Authored by Jeremiah Josey, 18 June 2009 It has been more than 12 years since I built one of my first major capital projects. I was 24 at the time. I hunkered down to do everything that needed to be done to build a major piece of critical infrastructure in a multi-billion dollar refining operation.…

Written by

-

The End of Royal Dutch Shell?

Today I read of the demise of Royal Dutch Shell – that huge unconscious behemoth employing 104,000 people around the world with 22B profits and revenues greater than USD300B per year. Well it wasn’t the specifically the demise, but the decision – that defining moment that will lead to Shell’s demise – that I read…

Written by

-

A Note to Arnold Schwarzenegger

I sent this email to Arnold a few days ago. Hi Arnold, I don’t know whether to call you Mr Schwarzenegger, Arnold, or Sir, but as I’ve grown up in Australia and formalities, well just aren’t the thing we focus on, so I figure Arnold will do for now. Today I drove for the first…

Written by