Tag: crude oil

-

The End of Oil? Oil Pricing for 2015 and the Rise of Solar Energy

Best Business Practices, Energy, Global Issues Affecting all of Us, Money, Solar Power, Technology, The Middle EastAuthor Jeremiah Josey I wrote this article for the Al Jarida newspaper and it was published on Saturday 24 January 2015. It’s a further development of my previous blog on how technology is changing the way the energy market operates and how the oil price may never rise again. It is published here: Al Jarida…

Written by

-

2015: The Year For the Downside of Solar Energy and the Upside of Banking

Author Jeremiah Josey, MECi Group Photographer: Chris Sattlberger/Getty Images Downside of Solar? Yes, downside. The side where you slide down and things get easier and more efficient, and lower priced, and better, and people want more of it. That’s what is happening with solar power. Look at this slope for US energy pricing: Source: EIA,…

Written by

-

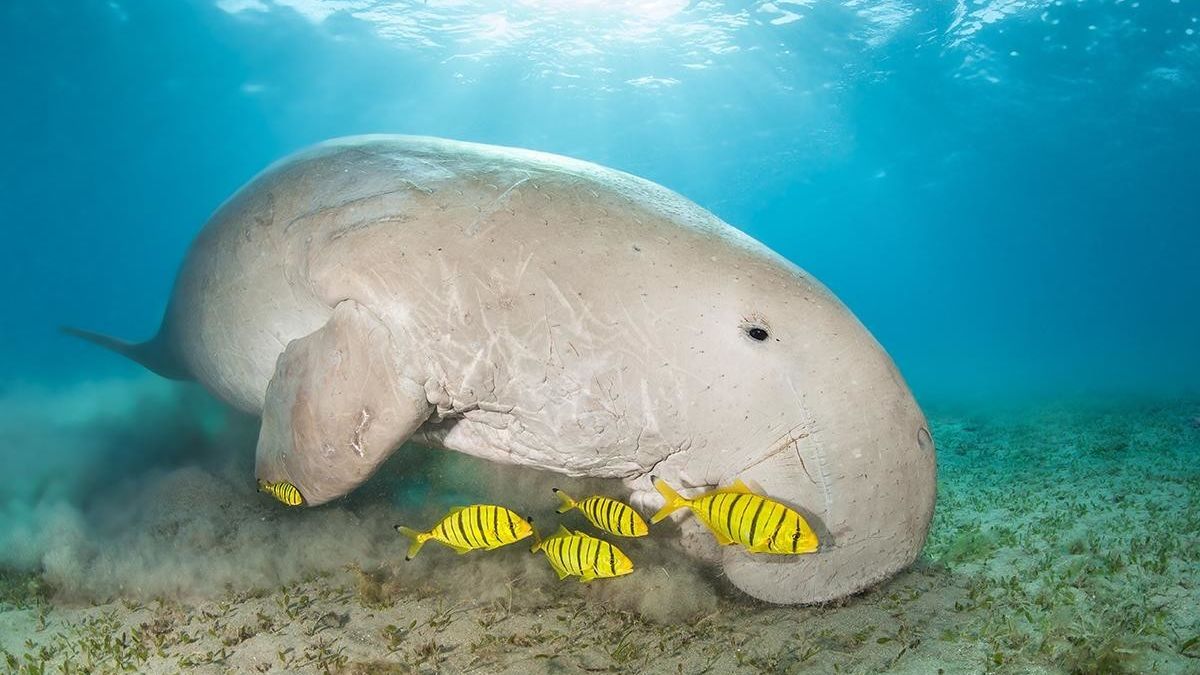

Leveraging Resources – Saving the Whales, and Dugongs

At the same time as I building my butane sphere I was also “Saving the Whales” or rather the dugongs. You see, the BP refinery was sitting at the mouth of the Brisbane River on a small peninsular of reclaimed land from the 1960’s. Every 6 to 36 hours a huge crude oil ship would…

Written by