Category: Best Business Practices

-

Demographics and market predictions – where Austrian reality trumps Keynesian mythology

Author Jeremiah Josey, 31 March 2020 Here is Robert Kiyosaki interviewing the great Harry S. Dent Jr. in a timely reminder of the importance of demographics. This is relevant in our covid-19 panic stricken world amid collapsing interest rates and voluminous fiat stimulus. The irony of our times: Keynesian based economics, or fluid fiscal spending.…

Written by

-

Having an Agenda – to build something

The agenda – do you take it or do you give it?

Written by

-

The Economics of Good Team Work – The Easy Way to Improve Business Profits for the Long Term

Author Jeremiah Josey I wrote this article for the Al Jarida newspaper and it was published on Saturday 21 February 2015. This article took a full page to discuss the economics of good team work for a business. It is published here: Al Jarida Article 21 Feb 2015 (Go to page 12) The Economics of Good Team…

Written by

-

The End of Oil? Oil Pricing for 2015 and the Rise of Solar Energy

Best Business Practices, Energy, Global Issues Affecting all of Us, Money, Solar Power, Technology, The Middle EastAuthor Jeremiah Josey I wrote this article for the Al Jarida newspaper and it was published on Saturday 24 January 2015. It’s a further development of my previous blog on how technology is changing the way the energy market operates and how the oil price may never rise again. It is published here: Al Jarida…

Written by

-

Seasons Greetings and Financial Events for 2015

Author Jeremiah Josey, MECi Group Hello! As we close the chapter on 2014 and turn our attention to what lies ahead for 2015, I think I can safely say that 2014 has been like no other. I’ve been studying the financial markets for several years and the signs are approaching quickly now that indicate it…

Written by

-

Do You Find Business Hard or Easy?

Author Jeremiah Josey, MECi Group I’ll say something about what I observe about business. People starting out for the first time with little business history of their own or in their family believe they have to do it themselves. That they can’t trust anyone. And they are frequently trying to prove something to an often…

Written by

-

Discussion with Kuwaiti Member of Parliament

Author Jeremiah Josey MECi Group A few nights ago I met up with recently elected member of Kuwait parliament the Right Honourable Nawaf Al Fuzaia. We discussed many things, one of which was about the prospect of doubling of the budget for the Government of Kuwait over the next 10 years. That reminded me about C. Northcote Parkinson and…

Written by

-

Eight Principles – Participative Management

Author Jeremiah Josey, MECi Group This article draws from something I read recently by Joan Lancourt and Charles Savage called Organizational Transformation and the Changing Role of the Human Resource Function What is participative management? I call it the humanising style of management that I advocate and endorse. Most of my articles describe different aspects…

Written by

-

Advice from Richard Branson: give your employees freedom

Post by Jeremiah Josey, MECi Group By Jack Preston of Virgin You won’t come across many people who have never had a boss. The thought of not having someone to answer to at work is a peculiar one for most people, however for Richard Branson it’s a natural state of affairs.”Having always worked for myself, I’ve never…

Written by

-

The Climb Takes Effort

Author Jeremiah Josey, MECi Group Focus, concentration, endeavour, planning. All of these things are needed to reach any height, obtain any position different to where you are currently. Realize that anyone who has anything in this life has obtained it through some effort of some kind. Even in supreme creation, what I call creating from…

Written by

-

Doing the Stuff that Matters – Box Number One!

Author Jeremiah Josey, MECi Group I remember a few years ago some very resonating training I received from Steve Covey (via a book, CD, DVD or something like that). It’s all about prioritising your work and revolves around two key concepts: Urgency and Importance. Importance means alignment to your strategy, your goals, your purpose. “If…

Written by

-

Social Engineering: Self-Organising, Collaborating Groups, or Sociocracy for short

Author Jeremiah Josey, MECi Group How do you improve human group dynamics, and allow people be more productive, business to be more profitable, groups to be more self reliant, whilst at the same time have it be more satisfying, more rewarding and straight out more enjoyable for the individuals involved? The solution: Develop a self…

Written by

-

Piracy? Or Different Rules of the Game

Author Jeremiah Josey, MECi Group This was a good read about so-called “piracy” in China (link here). What people do not understand is that this is not pirating. This has been labelled such by business lobbyists, out to protect their future revenue streams. Being a “Pirate” is taking something from someone else, something that is already owned.…

Written by

-

It’s all in how we learn…

Author Jeremiah Josey MECi Group The best learning is in the field; “on the job”, “through the school of hard knocks”. Getting getting lots and lots of “Nos” is how you work out what is right. The more Nos, the more you learn. This is how nature learns. Go watch it. Watch a vine climbing…

Written by

-

Lessons Everywhere – the comparative value of knowledge

Author Jeremiah Josey, MECi Group I changed a tyre today. It wasn’t my tyre. It belonged to an Egyptian vet, well he said he was egyptian and the back of his car was full of needles and drugs for camels so I assumed that was his occupation. He waved me down on the road, 1…

Written by

-

Ricardo Semler on Salaries

Post by Jeremiah Josey, MECi Group We set salaries like this: A lot of our people belong to unions, and they negotiate their salaries collectively. Everyone else’s salary involves an element of self-determination. Once or twice a year, we order salary market survey’s and pass them out. We say to people, “Figure out where you…

Written by

-

Ricardo Semler on Compensation

Post by Jeremiah Josey, MECi Group Employers began hiring workers by the hour during the Industrial Revolution. Their reasons were simple and rapacious. Say you ran out of cotton thread at 11:30 in the morning. If you paid people by the hour, you could stop the looms, send everyone home, and pay only for the…

Written by

-

Managing without Managers – Ricardo Semler

Post by Jeremiah Josey, MECi Group Managing without Managers by Ricardo Semler, Harvard Business Review (Sep-Oct 1989) In Brazil, where paternalism and the family business fiefdom still flourish, I am president of a manufacturing company that treats its 800 employees like responsible adults. Most of them –including factory workers – set their own working hours.…

Written by

-

Read The Manual

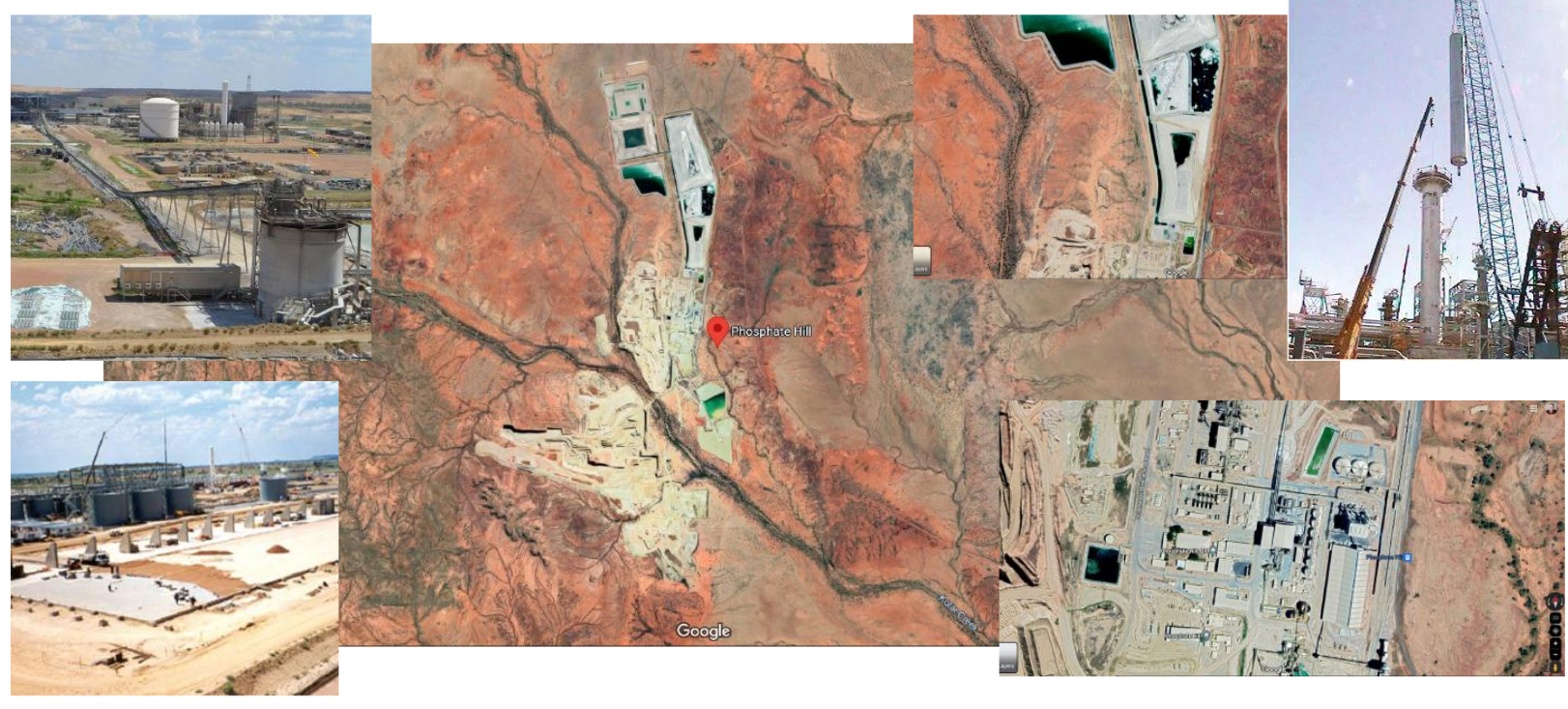

Author Jeremiah Josey, MECi Group A handful of years ago I was asked to join Western Mining and build a major part of their new AUD 1 billion fertiliser facility in far north western Queensland. Western Mining was then led by two icons of the Australian mining industry, Hugh Morgan and Andrew Michelmore. The facility…

Written by

-

Flying Solo or Craftsman, or Businessman??

Post by Jeremiah Josey, MECi Group This is a great discussion between Robert Gerrish or FlyingSolo and Michael Gerber, of E-Myth fame. Michael Gerber Interview by Robert Gerrish I made some comments to the interview: Business is a system. People working in the system have a “job”. Many solo runners in “business” operate in a…

Written by